1881-O Collecting

Sources

Search

Contact

Home

The history of grading coins and affixing a value based on grade is more exact and repeatable now than in the past, but it is still part form and part art. Usually is is the art part of the equation that drives collectors crazy, but not too long ago it was more the grading system itself.

Coin Collecting in General

Morgan Dollars and Grading Scales

Grading Services and Morgans

We collect for fun and challenge, but knowing the quality of what you are collecting has a great deal to do with the cost and ultimate the depth of your collection. Our current 70 point grading scale is known as the Sheldon Scale and was developed by Dr. William Sheldon in or around 1949.

Its original goal was to develop a scale whereby a collector would know that a grade 60 coin was worth 60 times the value of a grade 01 coin. But rarity and market conditions made the financial aspects of the scale impractical.

However, the need for a formal grading methodology and standards was apparent and the numerical scale stuck When the concept of the numerical scale was merged with the descriptive terms developed by the ANA.

But with Morgan Dollars the grading scale developed over time, and the good old "Law of Unintended Consequences" played, and continues to play, a major role in the pricing and grading. Perhaps this is appropriate given Congress' role in the Morgan Dollar creation.

Morgan Dollar Availability

From the creation of the Morgan Dollar they have been available for circulation and use. In fact, until the collecting craze really hit most Morgan Dollars sold for face value. You could readily buy individual, rolls, or bags of them at the Mint for personal use or collecting.

But Morgan Dollars were impractical for daily use because of their size and weight and their primary use became backing of Silver Certificate paper dollars. Imagine loading 100 Morgan Dollars in your pocket and going down the street to pay for something. This impracticality helped give rise to the collectibility because relatively large quantities remained in the Mint in original condition.

Survivability

Another factor greatly affecting the collectibility of Morgan Dollars is the uncertainty of the surviving quantities of any date and mint combination. We know in general what seems to circulate in the market, but many factors serve to create a mystique around the coin. If nothing else the attractiveness of selling Morgan Dollars for scrap when silver prices rise means that the quantity of surviving Morgan Dollars is always shrinking.

Under the Pittman Act of 1918 roughly half the dollars stored in the Mint were melted. Then another large portion of the remaining dollars were melted during World War I and World War II. Records regarding which dates and mint marks were melted were incomplete, so the surviving mint condition quantities are an unknown, but it is definitely a fraction of the original mintage. We know of no other coin that has had to endure as many trials and tribulations just to exist for collectors.

The unusual nature of Morgan Dollar grading arises from the government hoarding of the coins for bullion purposes, and the cessation of that practice in the 1960s when we went from a bullion backed currency to a fiat currency.

While the immediate reaction was that enormous quantities of mint state coins were available, in reality only a fraction of the original mintage remained. Collectors knew that even among the mint state coins some were better than others, and in the 1960s the uncirculated coins began to be designated as either Mint State 60 or Mint State 65 based on eye appeal.

At this time collectors and dealers could purchase bags of the coins directly from the Mint or banks, go through them and pick out the best, and then return the remaining coins for more. It naturally became obvious that some coins were better than others, hence the two designations.

Unintended Consequences

But this is where the law of unintended consequences starts to rear its head. Once sufficient quantities of coins began to be classified as either MS60 or MS65 it became apparent that within those coins some were better than others. A coin determined to be "Mint State" in theory could have a designation from MS60 through MS70.

But coins designated as MS60 could only be reclassified as MS60 or higher, whereas coins graded as MS65 could easily become MS63 through MS67. This disparity discouraged many early collectors who had coins downgraded. Imagine you have an MS65 that becomes an MS67, you hit the lottery. But if your MS65 became an MS63 you just struck out. The difference for Proof Like and Deep Mirror Proof Like states would have been even more dramatic, or catastrophic.

We know one family member who purchased several 1884-S, MS65 coins in the 1980s for $500 each. A fair market value for those was in fact $500 when purchased. But MS65 became fractionalized and his coins went in two different directions before grading. Today his true MS65 coins are worth $285,000 each, while his MS63 coins are worth a mere $55,000. You obviously won in either case, but it is the difference between winning the lottery and having a nice life.

The Grading March Goes On

It doesn't take a rocket scientist to realize that this continual desire to refine our opinion about the quality of coins leads to more and more fractionalizing of the grading classifications. Don't think this is over, or that it will end. We always have a desire to refine our opinions of coins.

Just think, in August of 2010 PCGS introduced the plus grade designations to indicate coins with exceptional eye appeal, a largely unquantifiable, aesthetic measure which can have big financial implications. Outside of Morgan Dollars there are "First Strikes," Cameos, color designations, and others. All of these serve to differentiate the type and quality of one coin from another.

The grading services play a major role in the availability and value of Morgan Dollars of all grades. All the major major grading services focus on mint state coins, or want to focus their attention there.

Mint State coins are graded based on appeal and physical damage during storage. The grading process is easier and as for profit companies they should focus here if it is in their best interest. The grades from AU on down are more difficult and are graded based on wear. These coins are more difficult and those doing the grading have a more difficult job.

Stated Values

The grading services usually value the below MS coins at less than melt value plus grading costs. This serves to discourage the grading of all but Mint State coins, and gives the impression that these coins are of little value. In many Morgan Dollar varieties there are few surviving Mint State coins, or the only affordable coins are below Mint State.

We would contend that below Mint State coins are never worth less than melt value plus the cost of grading. If they are then grading has no value.

The argument often used is that the free market is the determining factor in their value and not the grading service. If this is true then the grading services seem to us to be significantly undervaluing these coins. Spend a little time on any auction site and try to find a non-Mint State coin selling as low as suggested by the grading companies.

If you want to really have your mind blown, try to buy a Poor 01 coin in a date where fewer than two or three exist. These can run ten to twenty times the suggested values because of their rarity,

VAMs and Their Values

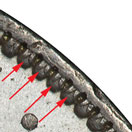

Now if you really want to complicate the issue, throw in VAMs. We can find no long term statistical data on the value of VAMs, especially when you consider the VAM/Grade combination. In the 1881-O series, PCGS only tracks three VAMs, and they do not track their sales prices. In theory there are seventy-two VAMs and twenty-six grades (not counting the plus grades and N grades) resulting in 1,872 possible collecting combinations for a full set.

Try that challenge on for size, and grab your wallet. To our knowledge it has never been either attempted or accomplished.

Morgans

The Mint

Statistics

Collecting

Features

Mint Marks

Mentoring

The Coin

Getting Started

Collecting The 1881-O

The 1881-O VAMs